What is An HSA?

Why are HSAs only available with a High Deductible Health Plan?

A health savings account (HSA) is a tax-advantaged savings account and are only available to people covered by an HDHP. The insured individual, or their employer, make regular contributions to the account. These funds are not subject to federal income taxes at the time of the deposit or withdrawal if the funds are used for qualified medical expenses that HDHPs don’t cover, including the deductible expenses.

NOTE: HSA contributions do not have to be spent or withdrawn during the tax year they were deposited. Any unused contributions can be rolled over—indefinitely.

For wealthy families who can afford to self-insure, an HDHP allows access to HSA tax-advantaged savings that they can use in retirement when the early withdrawal penalty for nonqualified expenses no longer applies.

However, if you are under the age of 65, any withdrawals for nonqualified expenses are subject to income tax and a 20% early withdrawal penalty.

Advantages and Disadvantages of a High-Deductible Health Plan (HDHP)

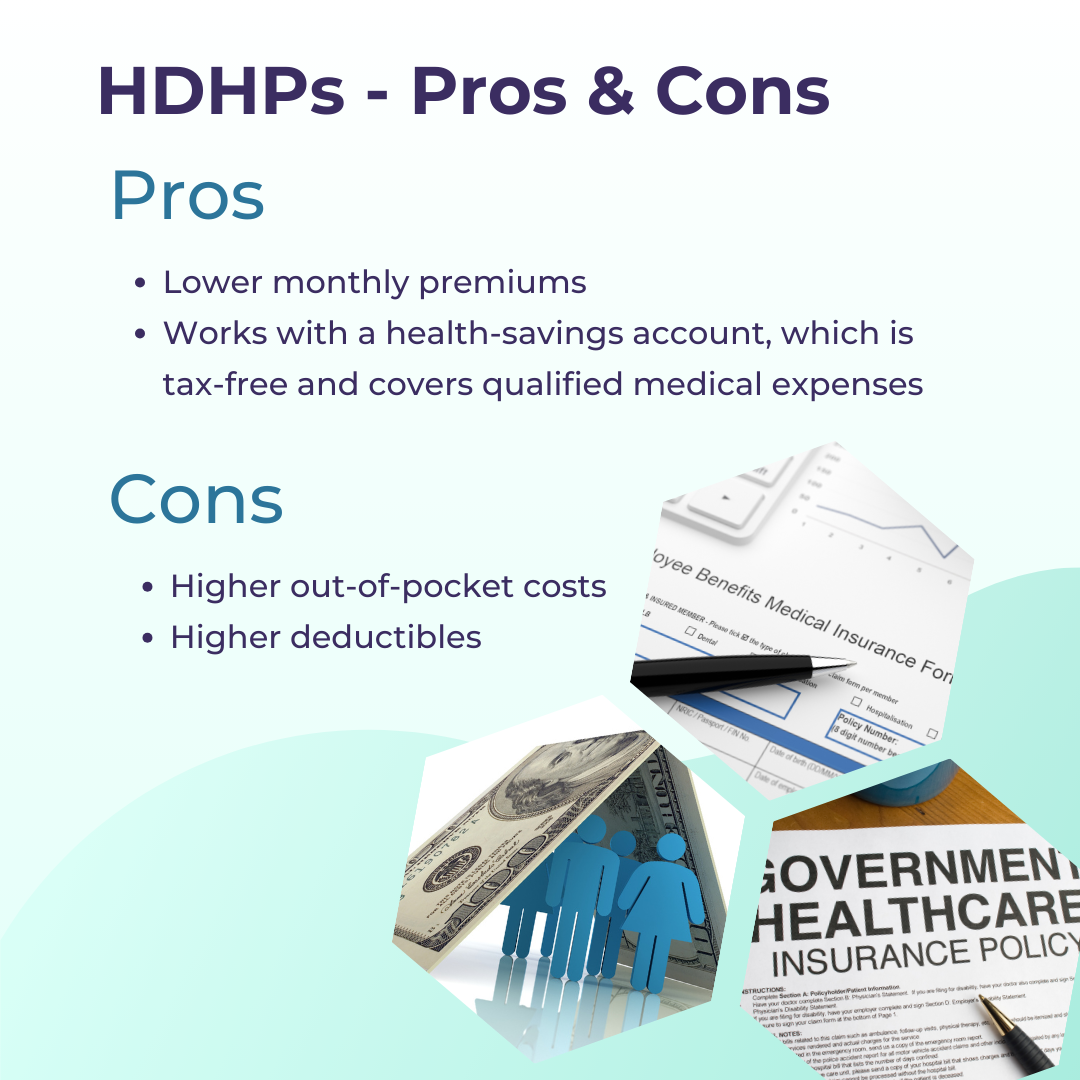

Advantages

Insured individuals with an HDHP end up paying lower monthly premiums. If you know that you are only going to need preventive care for the calendar year, then an HDHP would save you money.

Covered individuals are allowed to use a tax-advantaged HSA with an HDHP, so the money that you deposit into your HSA is tax-free and will help cut the cost of your high deductible.

Disadvantages

Higher deductibles mean that you have to pay more out of your own pocket for your medical and health care before the plan actually starts to pay for you. This can be a significant issue, if you have unexpected health issues.

Who Offers High-Deductible Health Plans?

You can get coverage under an HDHP through your employer. These plans are also available through government health care exchanges.

To read the full article on Investopedia, Click Here: https://www.investopedia.com/terms/h/hdhp.asp

To learn more about the government health care HDHPs, Click here: https://www.irs.gov/publications/p969

Learn More at the Barklee Financial Group