Tax Accounting Advisory Services

Creating Elegant Sustainable Solutions for Clients

Karen Collom, CPA is now part of Barklee Financial Group.

We are an accounting firm headquartered in Texas, offering comprehensive Tax Accounting Advisory Services, including accounting, bookkeeping, and tax assistance tailored for individuals and small- to medium-sized enterprises.

Established in 2004, the firm specializes in assisting businesses without an in-house bookkeeper, controller, or CFO, providing outsourcing solutions for these critical functions. In addition to serving domestic clients, the firm extends its services globally, catering to foreign nationals residing in the US and US Citizens living abroad.

We take a wholistic approach about our clients goals and map out activities and strategies that allow our clients to meet and exceed their goals. Our Team is committed to crafting sophisticated and sustainable solutions for both companies and individuals. Our belief is grounded in fostering a relationship that evolves alongside our clients' needs, spanning every phase of their life and business journey.

Latest IRS Updates

Firm Announcements

Karen Collom, CPA, Joined Barklee Financial Group

Over a year ago, on October 1, 2024, we became part of the Barklee Financial Group family.

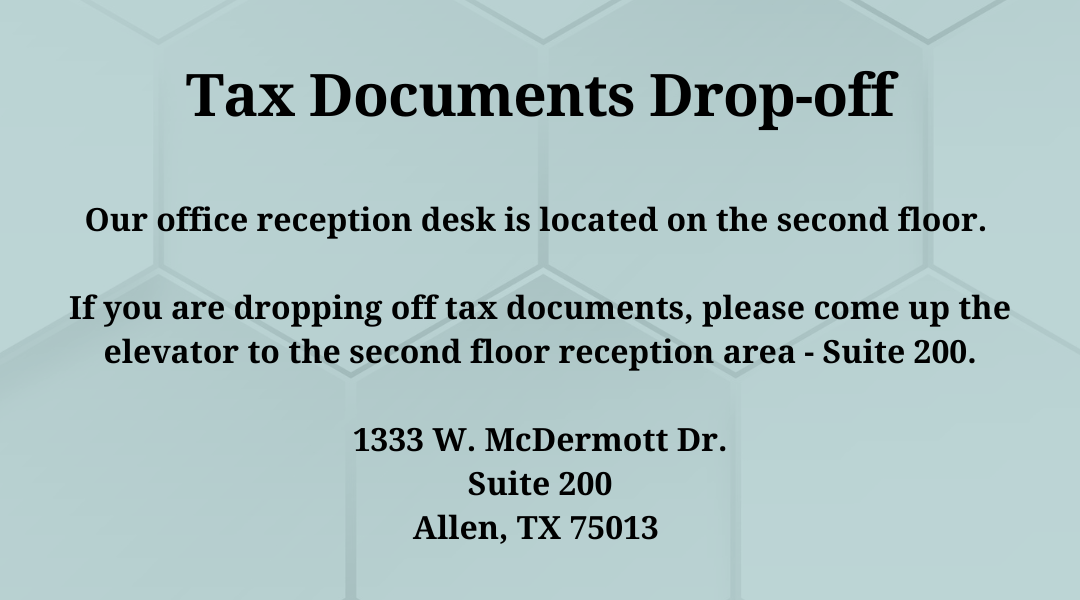

From our office in Allen, TX, Karen, Leah, and Donna continue to serve you with the same thoughtful attention and care you’ve come to rely on. This partnership ensures a continued commitment to providing exceptional financial services to clients of both firms.

Our Tax Advisory Services

Individuals

- Tax Preparation

- Tax Minimization Strategies

- Tax Advisory & Compliance

- Estate Settlement Services

- International Tax Services

Businesses

Bundled Tax & Accounting Packages

- Administrative/ Essential

- Professional

- Executive / Premium

- Tax Preparation

- Tax Minimization Strategies

- New Business Set-up Consulting

- Quickbooks Training and Support - for clients only

At this time, we are not accepting new full service business clients

Named Best in Allen, TX 2022

We are happy to announce that Karen Collom CPA , has been selected as the Winner for the 2022 Best of Allen Awards in the category of Certified Public Accountant.

Each year, in and around the Allen area, the Allen Award Program chooses only the best local businesses. The award is given to companies that have demonstrated their ability to use various marketing methods to grow their business in spite of difficult economic times.

The companies chosen exemplify the best of small business; often leading through customer service and community involvement.

Meet Our Team

The team at Karen Collom, CPA, works together to create sustainable solutions for our clients that allow for client growth and change. Building relationships is tantamount to what we do. Our clients entrust us with their financial security, and we never consider them just a number.

It's Accrual World Blog

What you need to know - all of the latest News and Updates from the IRS.

Trust is the foundation of a great business partnership

We offer a comprehensive range of Tax Advisory services, delivering income tax, accounting, and bookkeeping solutions to individuals, small businesses, and corporate clients. Our services are customized to meet the distinct needs of each client. Operating as an integral part of your team, we strive to comprehend your requirements and priorities.

| ✓ Trust | ✓ Expertise |

| ✓ Accuracy | ✓ Experience |

| ✓ Confidentiality | ✓ Professional |

Our Clients

Some of our clients, who count on us for all of their accounting needs.